Contents

A bond’s term to maturity is the specific period until a bond expires. This period influences a bond’s price, yield, and risk. By reading this article, you will learn how to calculate the term to maturity, understand the impact of bond features on the term, and assess the risk-reward trade-off associated with different bond maturities.

Understanding the term to maturity

A bond’s term to maturity is the duration of your investment. It’s the specific period during which you’ll receive regular interest payments and, ultimately, the principal amount when the bond matures. This maturity date is a fixed point in time, often years into the future.

The term to maturity is a crucial factor influencing a bond’s price and yield. Generally, longer-term bonds offer higher interest rates to compensate for the increased risk of holding them for extended periods.

Such a risk arises from potential fluctuations in interest rates. If interest rates rise, the value of your existing bond with a fixed interest rate may decline as newer bonds with higher interest rates become more attractive to investors.

Conversely, shorter-term bonds typically offer lower interest rates but are less sensitive to interest rate fluctuations. This is because they mature sooner, reducing the impact of changing interest rate environments.

Term to maturity example

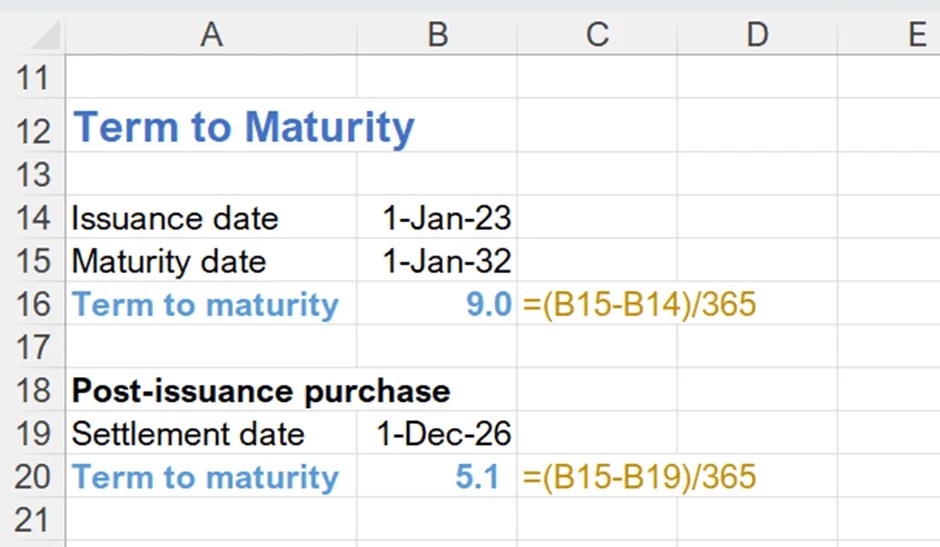

While the term to maturity is often directly stated on a bond certificate or in the bond prospectus, assuming you buy on the issue date, you can also calculate it using the bond’s issue date and maturity date.

Here’s a simple method:

- Identify the issue date and maturity date: These dates are typically provided in the bond’s documentation.

- Determine the time difference: Subtract the issue date from the maturity date. This can be done using a calendar or a financial calculator.

- Consider the time unit: The result will give you the time difference in days, months, or years.

Example: If a corporate bond was issued on January 1, 2023, and its maturity date is January 1, 2032, you can calculate the term to maturity as follows:

- Term to maturity: 2032 – 2023 = 9 years

Time to maturity (9 years) is the same as the tenor because you buy the bond on the issuance date.

Now, assume you buy the bond on December 1, 2026. To calculate the term to maturity more precisely, we need to consider the exact number of days between the purchase date and the maturity date.

We have the following information:

- Purchase date: December 1, 2026

- Maturity date: January 1, 2032

Step-by-step calculation

- Calculate the number of full years:

- 2031 – 2026 = 5 years (one day before maturing)

- Calculate the remaining days in the purchase year:

- December has 31 days.

- From December 1 to December 31, there are 31 days.

- Calculate the days in the maturity year:

- From December 31, 2031, to January 1, 2032, there is 1 day.

- Total number of days:

- (5 years * 365 days/year) + 31 days + 1 day = 1,857 days

Therefore, as of December 1, 2026, the bond has a term to maturity of approximately 1,857 days or 6.1 years.

Note: While this calculation assumes a standard year of 365 days, more precise calculations may require considering leap years and specific day count conventions used in the bond market, such as actual/actual or 30/360. Financial calculators and spreadsheet software are valuable tools for handling these complexities and providing accurate results.

The impact of bond features on the term to maturity

Certain bond features can influence the term to maturity:

- Callable bonds

- Puttable bonds

- Convertible bonds

Callable bonds

Callable bonds grant the issuer the right to redeem the bond before its maturity date, typically if interest rates decline. This allows the issuer to refinance the debt at a lower interest rate, shortening the bond’s term. For example, if interest rates fall significantly, the issuer may call the existing bonds and issue new bonds at a lower interest rate, reducing borrowing costs.

While advantageous for the issuer, this feature can be disadvantageous for the bondholder, who may be forced to reinvest the proceeds at a lower interest rate, potentially reducing their overall return. Callable bonds typically offer higher coupon rates to compensate bondholders for the call risk.

Puttable bonds

Puttable bonds give the bondholder the right to sell the bond back to the issuer before maturity, usually at a predetermined price. This feature offers significant flexibility, particularly in rising interest rate environments. If interest rates rise, the bondholder can sell the bond back to the issuer and reinvest the proceeds in higher-yielding bonds, shortening their investment duration.

However, puttable bonds may offer lower interest rates than non-puttable bonds, as the issuer compensates for the added flexibility granted to the bondholder. Puttable bonds can be particularly valuable during periods of economic uncertainty or volatile interest rates.

Convertible bonds

Convertible bonds grant the bondholder the right to convert the bond into shares of the issuer’s common stock. This conversion feature can significantly impact the term to maturity. If the stock price rises significantly, the bondholder may choose to convert the bond into shares, effectively shortening the bond’s term to zero. Conversely, if the stock price remains low, the bondholder may hold the bond until maturity, maintaining its original term.

The conversion option introduces uncertainty regarding the bond’s effective maturity and can significantly impact its investment characteristics. Due to the embedded option to convert into equity, convertible bonds often offer lower interest rates than comparable non-convertible bonds.

Balancing risk and reward

Interest rate risk is the potential for a bond’s price to decline due to rising interest rates. Longer-term bonds are more sensitive to interest rate fluctuations. By understanding the term to maturity, you can assess your exposure to this risk and make informed investment decisions.

The choice between short-term and long-term bonds involves risk-reward trade-offs. Short-term bonds offer lower yields but less interest rate risk, while long-term bonds provide higher yields but greater interest rate sensitivity.

When considering your investment horizon and risk tolerance, it’s important to carefully weigh the potential benefits and drawbacks of different bond maturities. Diversifying your bond portfolio across various maturities can help mitigate interest rate risk and optimize your overall investment strategy.

⬡ Start Your Journey Here: Fixed Income Basics.